Nike (NYSE:NKE) has not been rewarding investors as of late as its shares are down nearly 8% year-to-date. The iconic maker of athletic footwear and apparel has underperformed the S&P 500, which has risen 11.31% so far in 2023.

This weak stock price performance can be attributed to two key factors in my opinion: declining profitability and a rich valuation. Nike's shares pose the dilemma of growth versus value. As interest rates in the U.S. are rising, simply focusing on growth stocks and ignoring valuation may not be the best investment decision, as Nike is demonstrating now.

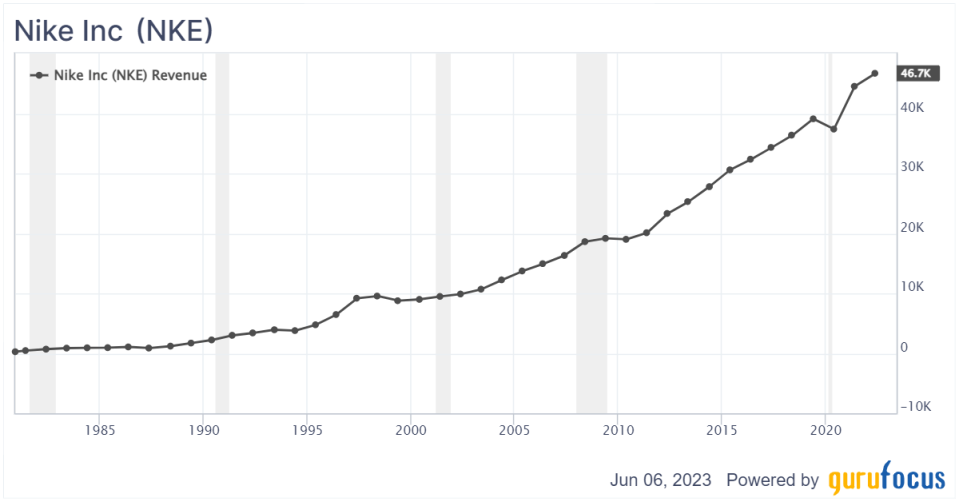

Nike has solid revenue growth and an excellent dividend payout history

Investors in Nike may not be glad with year-to-date stock price performance, but at least there has been an overall trend of growth in sales. A thorough analysis for the period 2010-2023 shows that with a few exceptions during 2020 and early 2021, Nike has very stable and rising revenue growth history. For example, Nike's annual revenue for 2022 was $46.71 billion, a 4.88% increase from 2021, which was much higher than the $37.403 billion in revenue recorded in 2019.

The latest third-quarter fiscal 2023 earnings showed revenue was up 14% compared to the year-ago quarter, or 19% on a currency-neutral basis, Direct sales increased 17% to $5.3 billion on a reported basis (22% currency-neutral), Brand Digital sales increased 20% (24% currency-neutral) and Wholesale revenues grew 12% (18% currency-neutral).

Nike has consistently increased its returns to shareholders, with 21 consecutive years of increasing dividend payouts. In the third quarter of fiscal 2023, Nike paid dividends of $528 million, an increase of 9% from the prior-year quarter, and repurchased shares worth $1.5 billion. Share repurchases are planned to continue as Nike approved a program of share repurchases worth $18 billion in June 2022, and for the quarter that ended on March 2023, the company had spent about $3.4 billion, or about 19% of its capital allocated for share repurchases. The dividend yield is a modest 1.26% as the share price has grown faster than its dividend.

Nike has a problem that is reflected by lower profitability

For the third quarter of fiscal 2023, Nike reported that its gross margin decreased 330 basis points to 43.3% and that diluted earnings per share for the quarter were $0.79, down 9% year-over-year. The gross margin, net profit and operating profit margins have all been headed lower over the past four consecutive quarters.

Assuming investors choose to focus mostly on the net profit margin for profitability, the decline is evident. For the quarter that ended in February 2022, the net profit margin was 13.06%. It then fell in the following quarters to 12.94%, 11.96%, 11.47% and 10.82%.

Valuation

For a stock with a declining bottom line, the valuation has become rich.

The stock has a price-earnings ratio of 30.32, a price-to-free-cash-flow ratio of 42.59 and a price-book ratio of 11.13. I do not see a clear thesis for a bargain stock at these levels.

On the bright side, Nike has a debt-to-equity ratio of 0.61, which is considered very healthy looking at its balance sheet.

Nikes economic moat looks sustainable

Despite the financial woes, Nike has a very strong economic moat in my view, primarily related to a strong brand. Nike has built one of the most recognizable and valuable brands in the world. The brand is associated with quality, innovation and performance. Nike's brand strength enables it to command premium pricing and maintain customer loyalty.

Nike has established a vast global distribution network, including both physical retail stores and e-commerce platforms. The company has a presence in numerous countries and leverages its network to reach a wide range of customers, from athletes and sports enthusiasts to casual wear consumers. Nike is renowned for its focus on product innovation and design. The company invests heavily in research and development to create technologically advanced and aesthetically appealing products. This commitment to innovation allows Nike to continually introduce new and improved products, giving it an edge over its competitors.

Nike has formed strategic partnerships and endorsem*nts with some of the world's top athletes, teams and sports organizations. Collaborations with athletes like Michael Jordan, LeBron James and Cristiano Ronaldo, among many others, have helped Nike maintain a strong presence in various sports and enhance its brand image. Nike benefits from economies of scale, which allow it to achieve cost advantages through bulk purchasing, efficient production and distribution. The company's extensive supply chain management capabilities help it optimize manufacturing and sourcing processes, ensuring timely delivery and cost control.

What about marketing and advertising? Nike is known for its impactful marketing campaigns that resonate with consumers. The company invests significant resources in advertising and promotional activities to create emotional connections with its target audience. This marketing prowess helps Nike stay top-of-mind and reinforce its brand image.

Lastly, Nike has successfully engaged with its customers through various means, including social media, mobile applications and membership programs. By building relationships with its customers and providing personalized experiences, Nike strengthens its moat and fosters brand loyalty.

While Nike enjoys a strong economic moat, it still faces competition from other sportswear brands. However, the company's consistent focus on innovation, brand strength, distribution and customer engagement has helped it maintain a dominant position in the industry.

The bottom line

Don't get me wroing, I love Nikes products for their quality, design and premium features. What about its stock? Unfortunately I do not believe the stock is attractive at this point due to the high valuation and declining profitability. The company has addressed risks like product input costs and elevated freight costs, but I would wait to see an improvement at least in profitability.

This article first appeared on GuruFocus.

I'm an enthusiast and expert in the field of finance and investment, with a deep understanding of market dynamics, stock analysis, and company valuation. My knowledge is not just theoretical; I've actively followed and analyzed the performance of various companies, including those in the athletic footwear and apparel industry.

Now, let's delve into the concepts mentioned in the article about Nike's stock performance:

-

Stock Performance: Nike's shares have declined nearly 8% year-to-date, underperforming the S&P 500, which rose 11.31% in 2023. The weak stock performance is attributed to declining profitability and a rich valuation.

-

Revenue Growth and Dividend Payout: Despite the stock price decline, Nike has shown solid revenue growth. The third-quarter fiscal 2023 earnings report indicates a 14% increase in revenue compared to the previous year. Nike has a consistent history of revenue growth, with dividends increasing for 21 consecutive years. The dividend payout in Q3 2023 was $528 million, a 9% increase from the prior year.

-

Profitability Challenges: Nike faces challenges in profitability, with a 330 basis points decrease in gross margin to 43.3% in Q3 2023. Diluted earnings per share were down 9% year-over-year. Net profit margins have shown a decline over the past four consecutive quarters.

-

Valuation: The article highlights a rich valuation for Nike, with a price-earnings ratio of 30.32, a price-to-free-cash-flow ratio of 42.59, and a price-book ratio of 11.13. Despite a declining bottom line, Nike maintains a healthy debt-to-equity ratio of 0.61.

-

Economic Moat: Nike's economic moat is attributed to its strong brand, global distribution network, focus on innovation, strategic partnerships with top athletes, economies of scale, and effective marketing campaigns. The brand strength allows premium pricing and customer loyalty.

-

Competition and Industry Position: While facing competition in the sportswear industry, Nike maintains a dominant position through its consistent focus on innovation, brand strength, distribution, and customer engagement.

-

Marketing and Advertising: Nike is known for impactful marketing campaigns that create emotional connections with consumers. The company invests significantly in advertising and promotional activities to reinforce its brand image and stay top-of-mind.

-

Customer Engagement: Nike engages with its customers through various channels, including social media, mobile applications, and membership programs, strengthening its moat and fostering brand loyalty.

In conclusion, while acknowledging the quality and design of Nike's products, the article suggests caution regarding the stock's attractiveness due to a high valuation and declining profitability. The author recommends waiting for an improvement in profitability before considering an investment in Nike.